Wage & Hour: DOL Doubles Down on Salary Threshold

Attorney for Employers

by Tal Burnovski Yeyni

818-907-3224

Considering all of the political movements regarding minimum wage, equal pay and other wage and hour concerns over the past few years, most employers could read the handwriting on the wall regarding overtime rules. That handwriting has now become official:

Considering all of the political movements regarding minimum wage, equal pay and other wage and hour concerns over the past few years, most employers could read the handwriting on the wall regarding overtime rules. That handwriting has now become official:

The Department of Labor Final Rule regarding the minimum salary level required for the exemption of executive, administrative and professional employees was released today.

In the event of a conflict between federal and state laws, employers must comply with the rule most favorable to employees. Prior to today’s Final Rule, an employee designated exempt under Federal law must have made at least $455 per week ($23,660 annually). This amount is substantially lower than the minimum salary required for exemption under California law, thus requiring California employers to comply with the state salary level test for exemption.

Here are the key changes:

- DOL Final Rule: Effective December 1, 2016, the “standard” salary level will increase to $913 per week (equivalent to $47,476 annually for a full-year employee), nearly double the current federal weekly threshold. The DOL launched a Frequently Asked Questions page here.

- California Employers: In this state, the current threshold is $41,600 ($3,466.67 monthly; $800 weekly), so California employers must comply with the higher Federal salary level (for exemption purposes) as of December 1st.

- Use of Bonuses to Satisfy the Test: Nondiscretionary bonuses and incentive payments (including commissions) may be used to satisfy up to 10 percent of the standard salary test requirement.Moreover, if an employee does not earn enough in nondiscretionary bonuses and incentive payments (including commissions) in a given quarter to retain their exempt status, the DOL now permits a “catch-up” payment at the end of the quarter. If the employer chooses not to make the catch-up payment, the employee would be entitled to overtime pay for any overtime hours worked during the quarter.

- Automatic Updates: To ensure effectiveness of the salary level test, the DOL will update the standard salary compensation requirements every 3 years, with the first update taking effect on January 1, 2020.

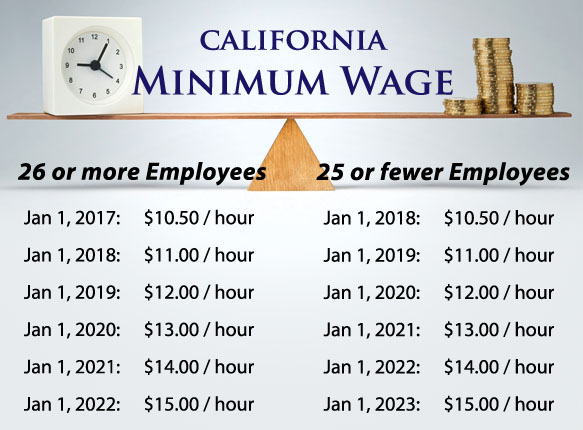

- Increase in California Minimum Wage Requirements: Note that last month, Governor Jerry Brown signed into law a bill gradually increasing California’s minimum wage to $15.00 per hour by January 1, 2022 (for employers with 26 or more employees). As the salary level for exemption is an extension of California’s minimum wage (two times the state’s minimum wage), employers must pay close attention to the automatic updates of the DOL and the increase in California’s minimum wage, to determine which salary test they must comply with for the exemption.

Here’s California’s newly approved Minimum Wage Schedule:

Wage and hour and other employment laws can become very confusing given how state and federal regulations can trump one another. Employers should seek the advice of experienced employment counsel to stay compliant.

Tal Burnovski Yeyni is an attorney in our Employment Practice Group.