How Does the DOMA Ruling Affect Estate Planning?

Trusts & Estate Planning Attorney

by Kira S. Masteller

818.907.3244

The United States Supreme Court’s ruling on Section 3 of the Defense of Marriage Act (DOMA) on June 26, declaring the definition of marriage as a union between one man and one woman unconstitutional, means same-sex couples in several states can now take advantage of certain tax savings when estate planning. For federal tax purposes, homosexual married couples will now be treated the same as heterosexual married couples.

Granted, the IRS is still struggling to determine how they will deal with individual and joint tax returns for same-sex couples. But federal estate planning benefits may now apply to same-sex married couples in California:

- Company Retirement Plans: The Employee Retirement Income Security Act of 1974 gives spouses the right to be sole beneficiaries of certain accounts.

- IRA Rollover Rights: When a spouse inherits funds from an IRA or other qualified plan, s/he can roll those assets into her or his own IRA account to postpone the required minimum distributions.

- Annual Exclusion Gifts: Any individual taxpayer can gift up to $14K per year, to as many beneficiaries as needed, without triggering gift taxes. Together, spouses can gift up to $28K either from individual or joint accounts.

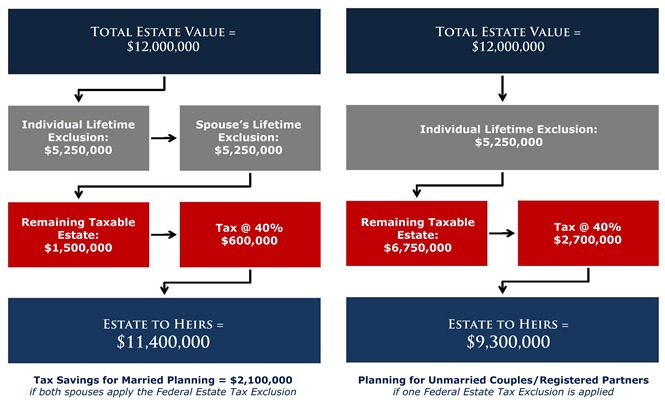

- Lifetime Gift Tax Exclusion: This one amounts to $5.25M for individuals, and $10.5M for married couples – significant savings for your estate.

- Portability: Speaking of the gift tax exclusion, portability allows the widow or widower to add the deceased spouse’s unused exclusion to their own exclusion, totaling up to the limit of $10.5M.

- Other Tax Breaks: Using a marital deduction, spouses can make transfers to each other during life or at death.

Keep in mind that a same-sex spouse who moves to a state where gay marriage is not recognized, may not qualify for these benefits. The ruling in United States v. Windsor simply says the federal government will recognize a couple’s marriage if the state where they reside recognizes the union.

Remember too, that the Prop 8 and DOMA rulings broke new ground in the legal landscape, and that for same sex couples in California and other states that recognize gay marriage, estate planning may be constantly changing for a while. Contact me if you need help keeping track of the current benefits and financial liabilities.

Kira S. Masteller is an Estate Planning Attorney and Shareholder at our firm. Email her at kmasteller@lewitthackman.com for more information.