Franchise 101: Pain at the Pump; and Pizza Franchisor Gets Burned

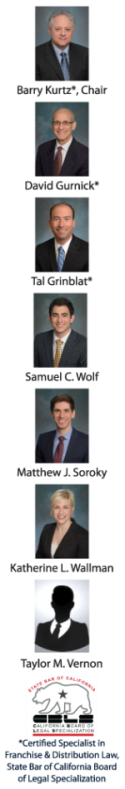

bkurtz@lewitthackman.com

dgurnick@lewitthackman.com

tgrinblat@lewitthackman.com

swolf@lewitthackman.com

msoroky@lewitthackman.com

kwallman@lewitthackman.com

tvernon@lewitthackman.com

May 2018

International Franchise Association’s Legal Symposium

Barry Kurtz, Tal Grinblat and David Gurnick attended the 51st Annual IFA Legal Symposium this month. The symposium addresses current laws, regulations and business challenges impacting franchise systems throughout the world.

We are Growing!

Taylor M. Vernon joined our Franchise & Distribution Practice Group as an Associate. Taylor earned his JD at the UCLA School of Law in 2011 and a B.A. in History from the University of Texas at Austin. Taylor’s practice focuses primarily on franchise, distribution, licensing and corporate transactions. With seven attorneys, we now have one of the largest franchise & distribution practice groups in the western United States.

FRANCHISOR 101:

Pain at the Pump

In Curry v. Equilon Enterprises LLC, a California court ruled, and the Court of Appeal affirmed, that a class-action wage and hour lawsuit against Shell Oil could not go forward because the service station manager bringing the suit was not an employee of Shell. The manager was employed by the company that contracted with Shell to operate the station.

Shell granted leases and operating agreements giving operators a rental interest in service station convenience stores and carwashes. Operators kept all profits from the convenience stores and carwashes. Shell paid the operators to run the station fuel facilities.

ARS had a contract with Shell to operate multiple stations. The plaintiff managed two locations. She was hired by an ARS employee, trained by ARS employees, reported to ARS employees, and supervised ARS employees. ARS designated the plaintiff as an exempt employee and set her salary.

The plaintiff brought a class-action suit against ARS and Shell, claiming she and other managers were misclassified as exempt employees, were denied overtime pay and were denied meal and rest breaks. The plaintiff also claimed that ARS and Shell were joint employers.

Definition of Employer

The appellate court noted three alternative definitions of what it means to employ someone:

- To exercise control over wages, hours or working conditions;

- To suffer or permit to work;

- To engage.

The court said the first definition did not apply because Shell did not control the plaintiff’s wages, hours or working conditions. ARS was responsible for training the plaintiff. ARS alone determined that she would be exempt from overtime requirements, where and when she would work, and her compensation and health benefits. And ARS controlled what the plaintiff did on a daily basis. The second definition did not apply because Shell had no authority to hire or fire the plaintiff.

As to the third definition, the court said “to engage” referred to the multifactor test used to determine if a worker is an employee or independent contractor. Under this test as well, the plaintiff was not employed by Shell. She was engaged in a distinct occupation. She was not supervised by Shell. Shell did not require a particular skill set for individuals hired by ARS. And Shell did not control her length of employment or compensation.

Read: Curry v. Equilon Enterprises LLC

Soon after this case was decided, the California Supreme Court, in Dynamex Operations West, Inc. v. Superior Court of Los Angeles, announced a new three-part test for determining if an individual is an employee or independent contractor for claims under California’s Wage Orders. To show that a worker is an independent contractor, a business must establish each of three factors: (A) the worker is free from control and direction of the hiring entity in performing the work, under the contract for the work and in fact; (B) the work is outside the usual course of the hiring entity’s business; and (C) the worker is customarily engaged in an independently established trade, occupation, or business. Failure to establish any one of these factors means a worker will be classified as an employee.

The Supreme Court’s decision will impact how many industries do business, and many businesses will need to re-examine their use of independent contractors, and their current agreements, to determine if re-classification is needed.

FRANCHISEE 101:

Pizza Franchisor Gets Burnt

A recent case from Indiana demonstrates consequences to a franchisor that deviates from the contractually agreed audit method. In Noble Roman’s Inc. v. Hattenhauer Distributing Co., an Indiana federal court granted a pizza franchisee (Hattenhauer) summary judgment on its franchisor’s underreporting claim.

In 2014, Noble Roman’s audited non-traditional franchisees who paid royalties based on reported sales. These audits included two of Hattenhauer’s locations. The audits relied on a review of Hattenhauer’s purchases from its distributor and estimates of Hattenhauer’s rate of waste, product mix, and pricing to estimate gross sales. Noble Roman’s did not review Hattenhauer’s books and records or verify the information in the distributor reports.

Based on the audits, Noble Roman’s concluded that Hattenhauer’s locations underpaid royalties. Without giving prior notice, Noble Roman’s tried to electronically withdraw funds from Hattenhauer’s bank account to cover the unpaid royalties. Hattenhauer’s bank rejected the attempted transfers. Noble Roman’s then made more attempts to withdraw the money, without providing Hattenhauer notice.

Noble Roman’s sued Hattenhauer, claiming it breached the Franchise Agreements by underreporting sales and failing to pay proper royalties. Noble Roman’s argued its audits were authorized under the Franchise Agreements. Hattenhauer counterclaimed, alleging that Noble Roman’s breached the Franchise Agreements by improper calculation of gross sales and unauthorized attempts to withdraw money. Hattenhauer argued that, pursuant to the Franchise Agreements, it was required to pay royalties on actual gross sales, not on sales that Noble Roman’s believed it should have achieved.

The court rejected Noble Roman’s argument, noting that royalties Noble Roman’s sought to collect were not properly calculated and therefore were not owed-and that nothing in the Franchise Agreements gave Noble Roman’s the right to collect unpaid royalties calculated based on an audit, by means of electronic withdrawals without Hattenhauer’s consent.

Franchisors should pay particular attention to the contractual rights they can enforce against franchisees and not exceed those rights in the process of collection efforts.

Read: Noble Roman’s Inc. v. Hattenhauer Distributing Co.