Employers’ Legislative Update: Governor Brown Signs New Bills

by Sue M. Bendavid & Tal Burnovski Yeyni

Tis the season for new laws in California and not all of it brings good tidings and cheer for employers.

Recently, Governor Jerry Brown signed several state Assembly and Senate Bills affecting those who employ domestic staff; agricultural workers; teachers; etc. Most companies with employees (or individuals with domestic staff) in California will be affected.

Here’s the current employment law update:

SB 1015 – Domestic Work Employees: Labor Standards

Previously, employees that worked as personal attendants were exempt from overtime and other wage and hour rules.

On January 1, 2014 the Domestic Worker Bill of Rights went into effect and provided that a “domestic work employee who is a personal attendant” is eligible for overtime at one and one-half times the employee’s regular rate of pay if the employee works more than nine hours per day or more than 45 hours per week. The Domestic Worker Bill of Rights was to be in effect until January 1, 2017 – at which time the legislature will decide whether to renew it.

SB 1015 deletes the repeal date, which means that the Domestic Worker Bill of Rights will remain in effect indefinitely.

AB 1066 – Agricultural Workers: Wage, Hours, and Working Conditions

Federal, state and local laws require employers to comply with wage and hour rules and pay non-exempt employees overtime and minimum wage – and to comply with meal and rest break rules.

Currently, Wage Order 14 sets different standards for overtime for agricultural employees (e.g., 1.5 times the employee’s regular rate of pay for hours worked beyond 10 hours per day and for the first eight hours or the 7th consecutive day of work; two times the employee’s regular rate of pay for all hours worked over eight on the 7th consecutive day.)

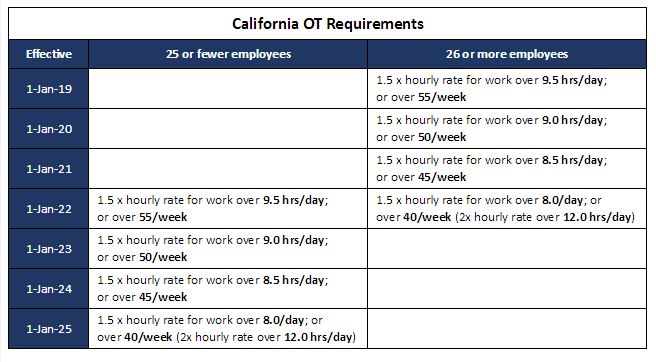

AB 1066 added sections 857 through 864 to the Labor Code which creates new overtime standards for agricultural employees (“under the same standards as millions of other Californians”), on a gradual basis:

The Governor is authorized to suspend a scheduled “phase-in” only if the Governor suspends a scheduled minimum wage increase (SB 3, signed in April). If suspension occurs, all phase-in dates will be postponed by an additional year.

AB 2337 – New Notice Requirement to Employees

Current law (Labor Code § 230.1) prohibits employers with 25 or more employees from retaliating or discharging employees who are victims of domestic violence, sexual assault, or stalking, for requesting time off to:

- Seek medical treatment;

- Obtain services from a domestic violence shelter or program; or

- Obtain counseling or participate in safety planning.

This act requires employers to give written notice to new employees regarding the right to take protected time off for the purposes stated above. The notice must also be provided to current employees upon request.

The Labor Commissioner will develop a form that employers may use to comply with this notice requirement. The notice will be available before July 1, 2017. Employers are not required to comply with notice requirement until the Labor Commissioner posts the form on the DLSE website.

AB 2230 – New OT Exemption Requirements for Certain Teachers

Current law provides that individuals employed as teachers at private elementary or secondary academic institutions are exempt from overtime payment requirements if, among others, they earn no less than two times the state minimum wage for full time employment.

This bill will change the salary requirement for the exemption. As of July 1, 2017, an individual employed as a teacher will be exempt if, among other criteria, the employee earns the greater of:

- No less than 100 percent of the lowest salary offered by any school district to a person in a position that requires a valid California teaching credential (excluding individuals employed in that position pursuant to an emergency permit, intern permit, or waiver); OR

- No less than 70 percent of the lowest scheduled salary offered by the school district or county in which the private elementary or secondary institution is located, to a person who is in a position that requires the person to have a valid California teaching credential (excluding individuals employed in that position pursuant to an emergency permit, intern permit, or waiver).

In effect, AB 2230 ties private school teaching salaries to that of public school teachers – establishing a wage floor that increases with the public sector.

Sue M. Bendavid and Tal Burnovski Yeyni are Employer Defense Attorneys at our Firm.