California Home Care Services: Senior Fraud Prevention

Estate Planning & Trust Attorney

by Kira S. Masteller

818.907.3244

According to the Federal Bureau of Investigation, elder abuse and senior fraud are common crimes because of several factors:

- Senior citizens tend to have valuable assets and good credit.

- They were generally raised to be more polite – many seniors have a hard time saying “no” or just hanging up the telephone when someone is still talking, selling or conning.

- Our elders are less likely to report a fraud or theft, either because they’re embarrassed to have been swindled by someone they trusted, or because they’re not sure how to proceed with a report or pursue legal action.

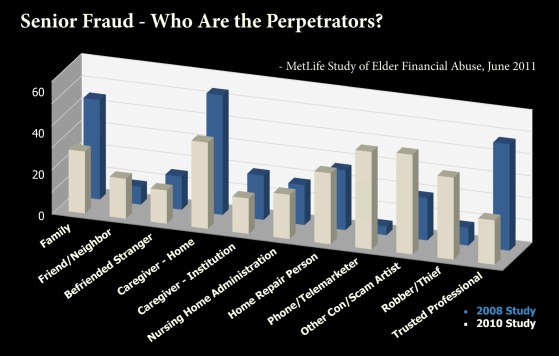

Number of senior fraud incidents reported in the media from April through June, in 2008 and 2010.So how do you prevent yourself or your loved ones from falling victim to elder exploitation or fraud?

An FBI web page lists a variety of Common Fraud Schemes that target seniors, involving everything from bogus health tests to medical equipment fraud, to investment scams and telemarketing crimes. But for this blog, we’re going to focus on financial fraud that arises from elderly home care.

Home Care Services and Elder Abuse

For many elders, living at home with a little or full-time daily assistance is a preferable alternative to moving into a nursing home. But if you’re choosing a caregiver for yourself or for a loved one, there are some things you should know to prevent exploitation or fraud.

- Current California law requires background checks for employees of community care facilities – but NOT for home caregivers. Look for an agency certified by Medicare that meets federal requirements for health and safety, and ask for references, preferably from doctors and other health care professionals.

- Inventory the jewelry and take photographs of the family valuables, particularly if they’re small and easily hidden in a pocket. Keep them locked up, and don’t keep a lot of cash in the home.

- Shred your mail (especially applications for credit cards), old checkbooks and any other items containing personal information, with a crisscross-cut shredder.

- Have monthly bank statements sent to a family member, CPA or some other professional advisor. Having a second set of eyes reviewing transactions will help stop thieves immediately. Fraudulent withdrawals on an account can reoccur for months without being noticed.

- Don’t share computer passwords with anyone, and make your passwords difficult to guess. How many of us use the same password for a number of websites, and how many of us use obvious passwords based on family member names, birthdates, pet names, etc?

Remember, a home care provider, whether needed on a temporary or full-time basis, is hopefully a person that you like and will eventually trust. But don’t trust too soon, and don’t trust the provider with anything to do with your finances, estate, or physical access to valuables.

Elder abuse and senior fraud can be prevented with common sense and vigilance.

Kira S. Masteller is a Gift Tax, Trust and Estate Planning Attorney. Contact her at 818.990.2120.